1QFY2020 Result Update | Dairy Products

August 7, 2019

Parag Milk Foods

BUY

CMP

`190

Performance Update

Target Price

`304

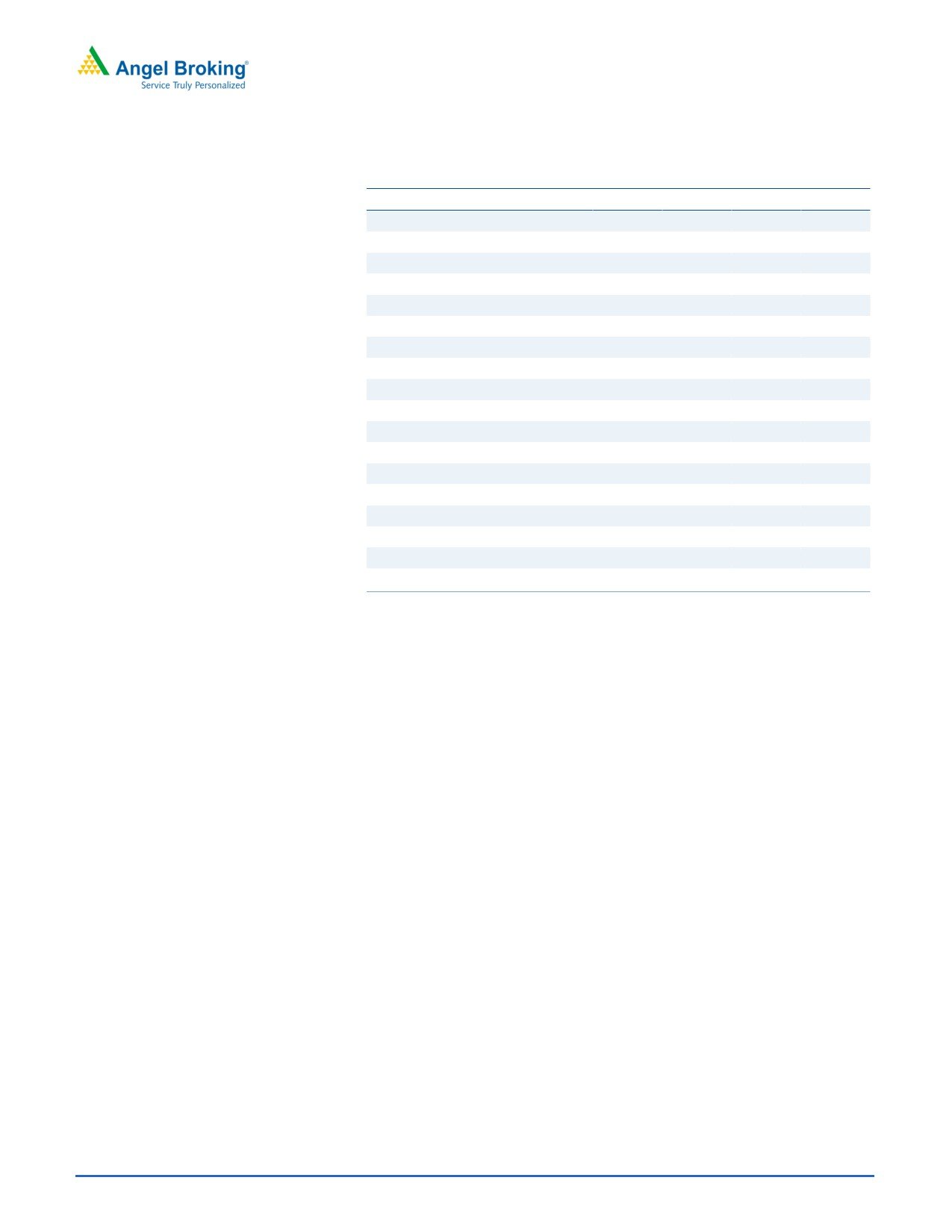

Y/E March (` cr)

1QFY20

1QFY19

% yoy

4QFY19

% qoq

Investment Period

12 Months

Net sales

630

549

14.6

672

(6.3)

EBITDA

57

60

(4.6)

44

30.1

Stock Info

EBITDA margin (%)

9.0

10.9

(182bp)

6.5

252bp

Sector

Dairy Products

Adjusted PAT

28

28

(2.7)

31

(12.1)

Market Cap (` cr)

1,569

Net Debt (` cr)

202

For 1QFY2019, Parag Milk Foods (PMFL) posted healthy numbers on top-line

front, however bottom-line was below expectation. The company’s revenue grew

Beta

1.1

by ~15% yoy, while the operating margins contracted by 182bps yoy. On the

52 Week High / Low

344/185

bottom-line front, PMFL reported de-growth of ~3% yoy to `28cr on the back of

Avg. Daily Volume

26,047

poor operating performance.

Healthy volume growth drives top-line: PMFL’s top-line grew by ~15% yoy due to

Face Value (`)

10

strong growth in value added products like cheese, ghee, paneer, etc., which grew

BSE Sensex

36,814

by ~16% yoy, whereas liquid milk registered growth of 7% yoy and skimmed milk

Nifty

10,885

grew by ~21% yoy.

Reuters

Code

PAMF.NS

Increase in milk procurement prices impacted the overall operating margin: On

the operating front, the company reported margin contraction of 182bps yoy at

Bloomberg Code

PARAG.IN

9.0%, which is mainly due to an increase in milk procurement prices (Due to

drought effect of last year and delayed monsoons, feed availability was severely

constrained leading to stress at farmer level. Therefore, raw milk prices paid to

Shareholding Pattern (%)

farmers increased sequentially during the quarter). On the bottom-line front, PMFL

Promoters

46.0

reported de-growth of

~3% yoy to `28cr on the back of poor operating

MF / Banks / Indian Fls

6.7

performance. We have already passed on the raw milk price increase by

combination of increased consumer prices and reduced trade discounts. The full

FII / NRIs / OCBs

17.4

effect of this correction will come from Q2 FY20.

Indian Public / Others

30.0

Outlook and Valuation: Parag Milk Foods is anticipated to post strong growth in

value added products on the back of its diversified product basket, strong brands

and wide distribution network. Further, PMFL would benefit from a shift in mix in

Abs. (%)

3m 1yr 3yr

favor of the organized market for dairy products. At the current market price, the

Sensex

(4.2)

(1.9)

31.2

company trades at a P/E of 9.4x its FY2021E EPS. Thus, we maintain our Buy

recommendation on PMFL with Target Price of `304.

PARAG

(14.8)

(14.8)

-

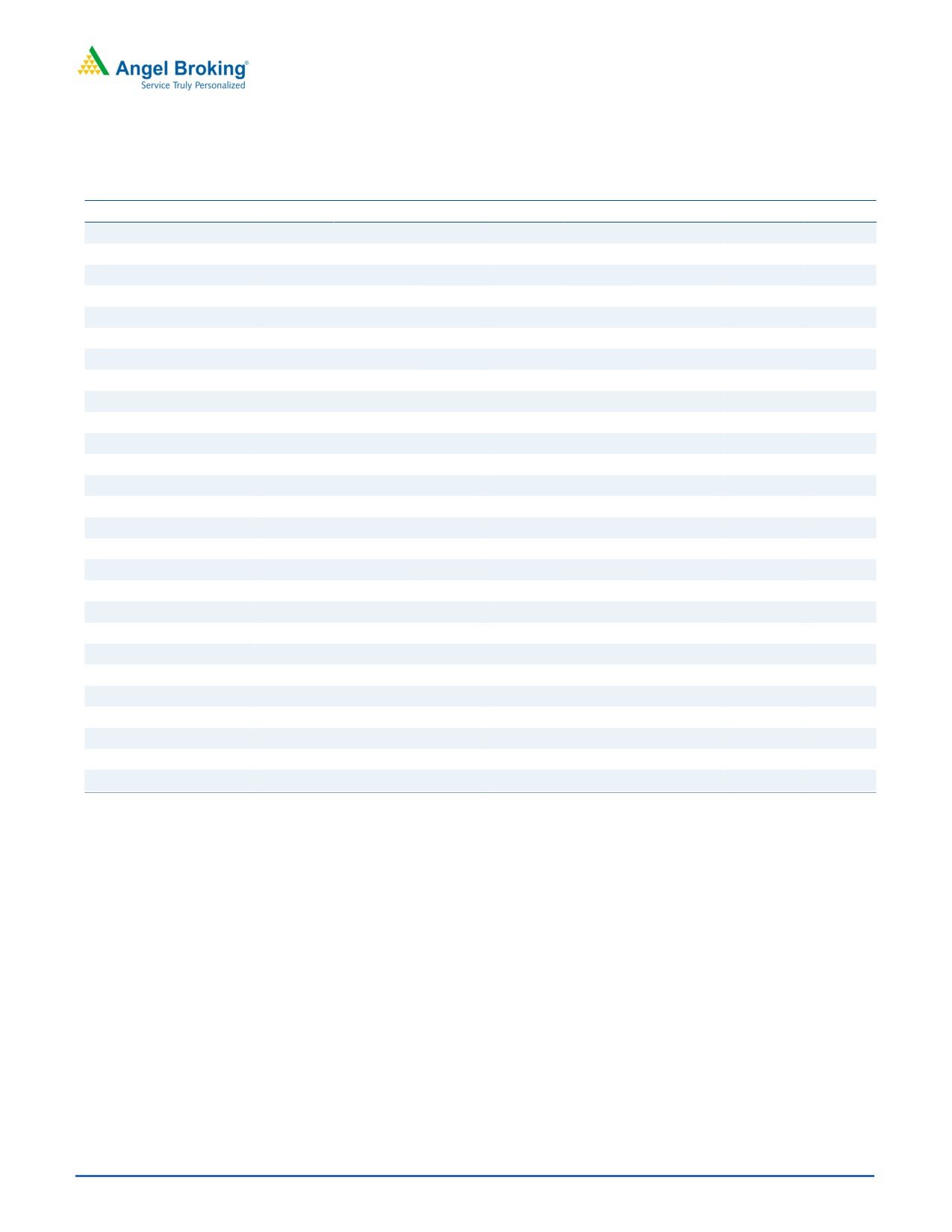

Key Financials

Price Chart

Y/E March (` cr)

FY2018

FY2019

FY2020E

FY2021E

Net Sales

1,986

2,396

2,763

3,177

% chg

14.8

20.6

15.3

15.0

Net Profit

89.2

120.7

144.7

170.6

% chg

(69.6)

35.4

19.9

17.9

OPM (%)

10.0

9.3

10.5

10.5

EPS (Rs)

10.6

14.3

17.2

20.3

P/E (x)

17.9

13.2

11.0

9.4

P/BV (x)

2.9

2.5

2.1

1.8

RoE (%)

12.4

14.4

14.8

14.8

Source: Company, Angel Research

RoCE (%)

14.9

16.5

19.6

20.0

EV/Sales (x)

Amarjeet S Maurya

0.9

0.8

0.6

0.5

022 - 3935 7800 Ext: 6831

EV/EBITDA (x)

9.1

8.1

6.1

5.1

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Parag Milk Foods |1QFY2020 Result Update

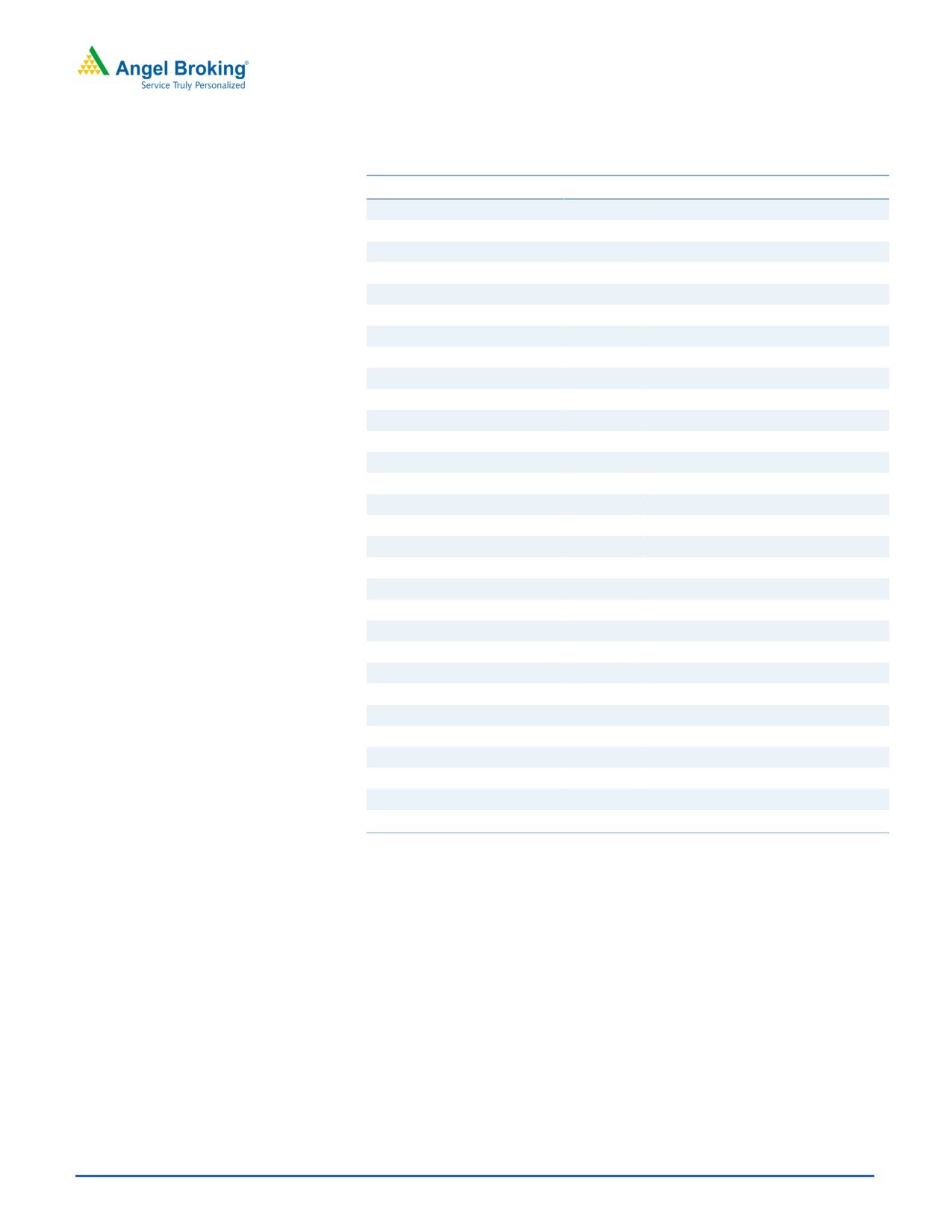

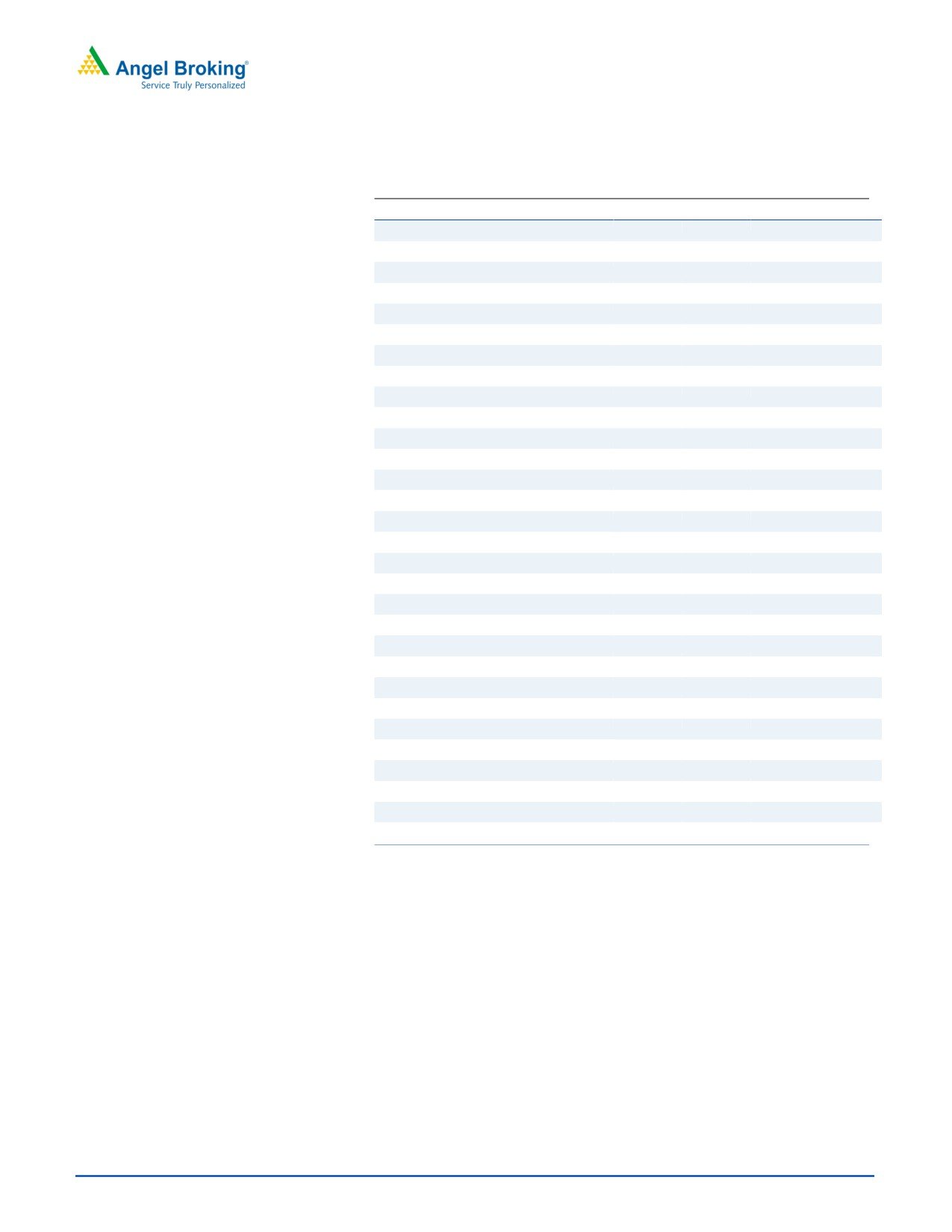

Exhibit 1: 1QFY2020 Performance

Y/E March (` cr)

1QFY20

1QFY19

% yoy

4QFY19

% qoq

FY2019

FY2018

% chg

Net Sales

630

549

14.6

672

(6.3)

2396

1955

22.6

Consumption of RM

461

383

20.6

473

(2.5)

1,657

1,368

21.2

(% of Sales)

73.3

69.6

70.4

69.2

70.0

Staff Costs

27

20

30.8

26

3.2

95.0

73.5

29.2

(% of Sales)

4.2

3.7

3.9

4.0

3.8

Other Expenses

85

87

(2.1)

129

(34.4)

419.8

319.8

31.3

(% of Sales)

13.5

15.8

19.3

17.5

16.4

Total Expenditure

573

490

17.0

628

(8.8)

2,172

1,761

23.3

Operating Profit

57

60

(4.6)

44

30.1

224

193

15.6

OPM

9.0

10.9

6.5

9.3

9.9

Interest

9

10

(8.2)

8

19.3

35.8

35.7

0.2

Depreciation

13

14

(1.9)

9

41.1

50

51

(0.8)

Other Income

3

2

57.9

6

(55.7)

10

12

(14.5)

PBT (excl. Ext Items)

37

38

(1.7)

33

12.9

148

119

24.2

Ext (Income)/Expense

-

-

-

-

-

PBT (incl. Ext Items)

37

38

(1.7)

33

12.9

148

119

24.2

(% of Sales)

5.9

6.9

4.9

6.2

6.1

Provision for Taxation

10

9

1.2

2

516.1

27.1

30.1

(10.0)

(% of PBT)

25.8

25.0

4.7

18.3

25.3

Reported PAT

28

28

(2.7)

31

(12.1)

120.71

89

35.8

PATM

4.4

5.1

4.7

5.0

4.5

Minority Interest After NP

Reported PAT

28

28

(2.7)

31

(12.1)

121

89

35.8

Extra-ordinary Items

Adj PAT

28

28

(2.7)

31.3

(12.1)

121

89

35.8

Equity shares (cr)

8

8

8

8

8

FDEPS (Rs)

3.3

3.4

(2.7)

3.7

(12.1)

14.4

10.6

35.8

Source: Company, Angel Research

August 7, 2019

2

Parag Milk Foods |1QFY2020 Result Update

Outlook and Valuation

Parag Milk Foods is anticipated to post strong growth in value added products on

the back of its diversified product basket, strong brands and wide distribution

network. Further, PMFL would benefit from a shift in mix in favor of the organized

market for dairy products. At the current market price, the company trades at a P/E

of 9.4x its FY2021E EPS. Thus, we maintain our Buy recommendation on PMFL

with Target Price of `304.

Risks to our estimates

1) Inability to procure sufficient good quality raw milk at commercially viable

prices.

2) Increase in competitive intensity.

August 7, 2019

3

Parag Milk Foods |1QFY2020 Result Update

Profit & Loss Statement

Y/E March ( ` cr)

FY2018

FY2019

FY2020E

FY2021E

Total operating income

1,986

2,396

2,763

3,177

% chg

14.8

20.6

15.3

15.0

Total Expenditure

1,788

2,172

2,472

2,843

Raw Material

1,303

1,657

1,934

2,224

Personnel

85

95

110

126

Others Expenses

400

420

428

492

EBITDA

198

224

291

335

% chg

(42.8)

12.9

30.2

15.0

(% of Net Sales)

10.0

9.3

10.5

10.5

Depreciation& Amortisation

52

50

57

61

EBIT

146

173

234

274

% chg

(50.8)

18.5

35.3

16.7

(% of Net Sales)

7.4

7.2

8.5

8.6

Interest & other Charges

36

36

38

40

Other Income

9

10

10

10

(% of PBT)

7.9

6.9

5.0

4.2

Share in profit of Associates

-

-

-

-

Recurring PBT

119

148

207

244

% chg

(56.6)

23.9

39.9

17.9

Tax

30

27

62

73

(% of PBT)

25.3

18.3

30.0

30.0

PAT (reported)

89

121

145

171

Extraordinary Items

-

-

-

-

Less: Minority interest (MI)

PAT after MI (reported)

89

121

145

171

ADJ. PAT

89

121

145

171

% chg

(69.6)

35.4

19.9

17.9

(% of Net Sales)

4.5

5.0

5.2

5.4

Fully Diluted EPS (`)

10.6

14.3

17.2

20.3

% chg

148.1

35.4

19.9

17.9

August 7, 2019

4

Parag Milk Foods |1QFY2020 Result Update

Consolidated Balance Sheet

Y/E March (` cr)

FY2018

FY2019

FY2020E

FY2021E

SOURCES OF FUNDS

Equity Share Capital

84

84

84

84

Reserves& Surplus

633

753

897

1,066

Shareholders Funds

717

837

981

1,150

Equity Share Warrants

-

-

-

-

Total Loans

264

214

214

214

Deferred Tax Liability

-

-

-

-

Other liabilties

9.4

9.4

9.4

9.4

Total Liabilities

921

1,118

1,264

1,435

APPLICATION OF FUNDS

Gross Block

645

705

765

825

Less: Acc. Depreciation

278

328

385

446

Net Block

367

377

380

379

Capital Work-in-Progress

20

20

20

20

Investments

5

-

-

-

Current Assets

905

938

1,115

1,323

Inventories

438

459

530

609

Sundry Debtors

252

282

325

374

Cash

50

12

47

95

Loans & Advances

166

185

213

245

Other Assets

-

-

-

-

Current liabilities

396

242

282

325

Net Current Assets

509

696

833

999

Deferred Tax Asset

8

8

10

11

Mis. Exp. not written off

12

16

20

26

Total Assets

921

1,118

1,264

1,435

August 7, 2019

5

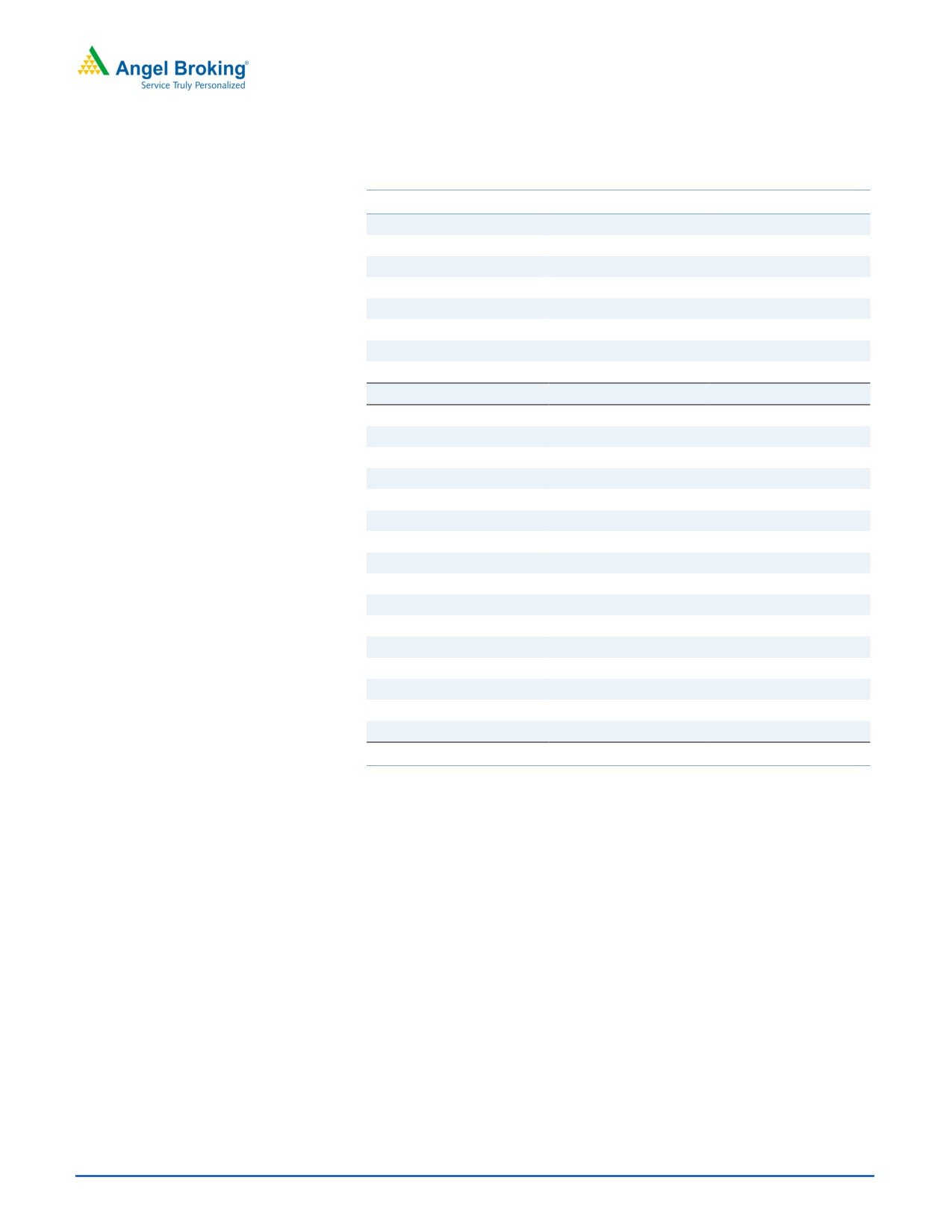

Parag Milk Foods |1QFY2020 Result Update

Exhibit 2:

Y/E March (` cr)

FY2018

FY2019

FY2020E FY2021E

Profit before tax

119

148

207

244

Depreciation

52

50

57

61

Change in Working Capital

(64)

(225)

(102)

(118)

Interest / Dividend (Net)

36

36

38

40

Direct taxes paid

(30)

(27)

(62)

(73)

Others

0

0

0

0

Cash Flow from Operations

113

(18)

138

154

(Inc.)/ Dec. in Fixed Assets

(60)

(60)

(60)

(60)

(Inc.)/ Dec. in Investments

61

(4)

(5)

(6)

Cash Flow from Investing

1

(64)

(65)

(66)

Issue of Equity

0

0

0

0

Inc./(Dec.) in loans

1

(50)

0

0

Dividend Paid (Incl. Tax)

0

0

0

0

Interest / Dividend (Net)

(36)

(36)

(38)

(40)

Cash Flow from Financing

(35)

(85)

(38)

(40)

Inc./(Dec.) in Cash

78

(167)

35

48

Opening Cash balances

101

179

12

47

Closing Cash balances

179

12

47

95

Source: Company, Angel Research

August 7, 2019

6

Parag Milk Foods |1QFY2020 Result Update

Key Ratios

Y/E March

FY2018

FY2019

FY2020E

FY2021E

Valuation Ratio (x)

P/E (on FDEPS)

17.9

13.2

11.0

9.4

P/CEPS

14.9

14.9

12.3

10.4

P/BV

2.9

2.5

2.1

1.8

Dividend yield (%)

0.1

0.1

0.1

0.1

EV/Sales

0.9

0.8

0.6

0.5

EV/EBITDA

9.1

8.1

6.1

5.1

EV / Total Assets

2.0

1.6

1.4

1.2

Per Share Data (`)

EPS (Basic)

10.6

14.3

17.2

20.3

EPS (fully diluted)

10.6

14.3

17.2

20.3

Cash EPS

16.7

16.7

20.3

23.9

DPS

0.1

0.1

0.1

0.1

Book Value

85.2

99.5

116.6

136.8

Dupont Analysis

EBIT margin

7.4

7.2

8.5

8.6

Tax retention ratio

0.7

0.8

0.7

0.7

Asset turnover (x)

2.1

2.3

2.4

2.5

ROIC (Post-tax)

11.8

13.6

14.3

15.1

Cost of Debt (Post Tax)

0.1

0.1

0.1

0.1

Returns (%)

ROCE

14.9

16.5

19.6

20.0

Angel ROIC (Pre-tax)

15.8

16.7

20.4

21.5

ROE

12.4

14.4

14.8

14.8

Turnover ratios (x)

Asset Turnover (Gross Block)

3.1

3.4

3.6

3.9

Inventory / Sales (days)

92

80

70

70

Receivables (days)

53

45

43

43

Payables (days)

102

99

53

53

Working capital cycle (ex-cash) (days)

43

27

60

60

Source: Company, Angel Research

August 7, 2019

7

Parag Milk Foods |1QFY2020 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Parag Milk Foods

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on Expected Returns:

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period)

Reduce (-5% to -15%)

Sell (< -15%)

August 7, 2019

8